Good morning.

In January the reality of actions and consequences will be brought home in spades. Taxes will increase for everyone in the middle class (in theory protected by Obama) and above.

The reality of the situation is this: Even Ryan's tax plan was would not have cut spending. It would have reduced the rate of increase.

Obama's plan is to cover the increased rate of spending through tax increases. In actuality there is not enough money available to cover the current expenditures. We all know that no government program ever lives within the budget established, and whatever the budget finally is (remember that the govt uses a budgeting process that builds on last years, and it now includes the simulus that was to be an one time expense) will cause the printing presses to roll. This does not even consider that no tax increase has ever yielded the expected outcome. Money will flow out of the country in record amounts reducing the amount on which the new rates will apply. Remember it is not illegal to avoid taxes (yet) or to move money offshore (yet).

Currently the US borrows $0.40 of every dollar spent. It will only go up.

Other and taxes how will this be repaid? Inflation friends. I know the rates are low now. They are being held artifically low by the central bank taking action to do so. How does this work? For us it is the equivalent of using one credit card to payoff another. For the central bank the last was named QE3 (quantitive easing 3rd attempt). That is where the central bank issues bonds which are used to purchase the national debt. Slick right?

The was a Fox report a couple of months ago that showed a family of 4 making $24k a year & using all govt programs available to them actually had more disposable income than a family of 4 making $60k a year. $60k by the way is in the top 10% of wage earners. It does not take a real leap in cognitve thinking to understand why it is difficult to get people off the dole. Why would someone go to work at their level of ability if they are going to have less money? Just vote in those who will give money to you.

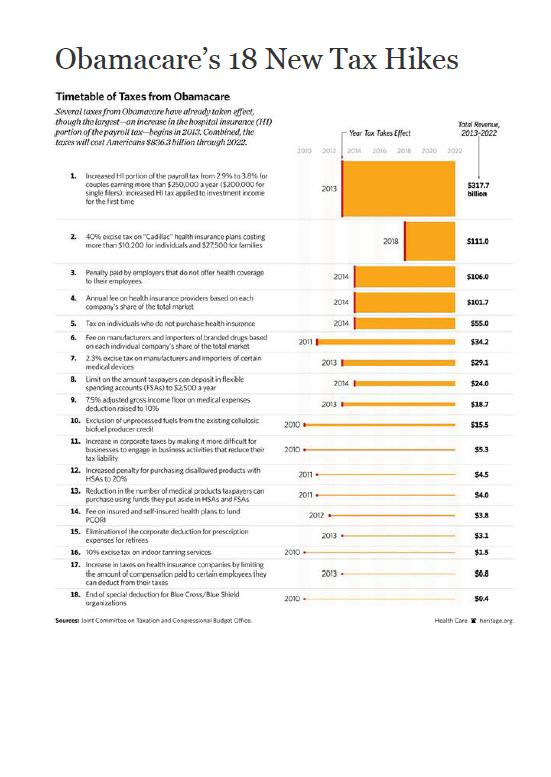

This discussion does not consider the tax burden that will be realized from Obamacare i.e. a federal tax on real property transactions, medical devices and others.

I fear we are past the tipping point. Take the famous 47% add the SEIU, UAW, and various teachers unions and it will be some where at or above 50%. Greece can only be around the corner.

Options are limited. Australia will not take those of us over 55. New Zealand is probably similar to Australia. Canada will not take us at all unless one is willing to stash a significant amount of $ in a Canadian bank & provide your own health care. Mexico will not allow us to own property (dangerous anyway) or immigrate (strange wouldn't you say).

I have never worked for a company that was successful which did not have a strong CEO and/or CFO. Neither exists in the Executive Branch. Remember the head of the IRS claimed he could not figure out how to use TurboTax.

I hope I have not spoiled your weekend.

William J. Rutherford

The following PowerPoint file has some interesting facts about the amount you pay in taxes.

In January the reality of actions and consequences will be brought home in spades. Taxes will increase for everyone in the middle class (in theory protected by Obama) and above.

The reality of the situation is this: Even Ryan's tax plan was would not have cut spending. It would have reduced the rate of increase.

Obama's plan is to cover the increased rate of spending through tax increases. In actuality there is not enough money available to cover the current expenditures. We all know that no government program ever lives within the budget established, and whatever the budget finally is (remember that the govt uses a budgeting process that builds on last years, and it now includes the simulus that was to be an one time expense) will cause the printing presses to roll. This does not even consider that no tax increase has ever yielded the expected outcome. Money will flow out of the country in record amounts reducing the amount on which the new rates will apply. Remember it is not illegal to avoid taxes (yet) or to move money offshore (yet).

Currently the US borrows $0.40 of every dollar spent. It will only go up.

Other and taxes how will this be repaid? Inflation friends. I know the rates are low now. They are being held artifically low by the central bank taking action to do so. How does this work? For us it is the equivalent of using one credit card to payoff another. For the central bank the last was named QE3 (quantitive easing 3rd attempt). That is where the central bank issues bonds which are used to purchase the national debt. Slick right?

The was a Fox report a couple of months ago that showed a family of 4 making $24k a year & using all govt programs available to them actually had more disposable income than a family of 4 making $60k a year. $60k by the way is in the top 10% of wage earners. It does not take a real leap in cognitve thinking to understand why it is difficult to get people off the dole. Why would someone go to work at their level of ability if they are going to have less money? Just vote in those who will give money to you.

This discussion does not consider the tax burden that will be realized from Obamacare i.e. a federal tax on real property transactions, medical devices and others.

I fear we are past the tipping point. Take the famous 47% add the SEIU, UAW, and various teachers unions and it will be some where at or above 50%. Greece can only be around the corner.

Options are limited. Australia will not take those of us over 55. New Zealand is probably similar to Australia. Canada will not take us at all unless one is willing to stash a significant amount of $ in a Canadian bank & provide your own health care. Mexico will not allow us to own property (dangerous anyway) or immigrate (strange wouldn't you say).

I have never worked for a company that was successful which did not have a strong CEO and/or CFO. Neither exists in the Executive Branch. Remember the head of the IRS claimed he could not figure out how to use TurboTax.

I hope I have not spoiled your weekend.

William J. Rutherford

The following PowerPoint file has some interesting facts about the amount you pay in taxes.

| some_consequences_of_nov_6.ppsx |

Obamacare’s 18 New Tax Hikes